Vodafone Qatar P.Q.S.C. (“Vodafone Qatar” or the “Company”) announces that trading in the Company’s shares will be suspended for one day on Thursday, 15 November 2018, as per regulatory requirements, on account of its previously announced capital reduction that will take effect on the same day. Trading in the Company’s shares will resume on Sunday, 18 November 2018.

Vodafone Qatar obtained its shareholders approval at the Company’s Extraordinary General Assembly on 19 March 2018, in addition to all requisite regulatory approvals, to proceed with the implementation of the capital reduction.

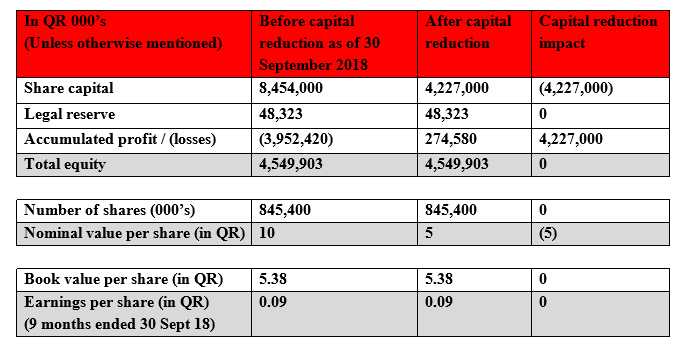

The capital reduction is essentially a balance sheet transaction effected by means of an accounting adjustment all within the “Total Equity” section. The share capital of the Company will be reduced from QAR 8,454,000,000 to QAR 4,227,000,000 by way of reducing the nominal value of the shares of the Company from QAR 10 per share to QAR 5 per share. The transaction has no impact whatsoever on the value or the number of the shares held by shareholders or on the cash position or financial liquidity of the Company.

The objective of the capital reduction is to enable the Company to extinguish its accumulated losses associated with the amortisation costs of the Company’s Telecommunications Networks and Services Licence. This delivers the long-term growth potential of the Company, attracts new investors and enables future payment of dividends in line with the applicable law and the Company’s Articles of Association.

Attached is a table highlighting the impact of the capital reduction on Vodafone Qatar’s financial statements and indicators.

The impact of Vodafone Qatar P.Q.S.C (“the Company”) capital reduction

on the Company’s financial statements and indicators

* Vodafone Qatar Extraordinary General Assembly held on 19 March 2018 approved that any remaining losses up to a maximum amount of QAR 45 million would be netted-off against the Company’s distributable reserves.